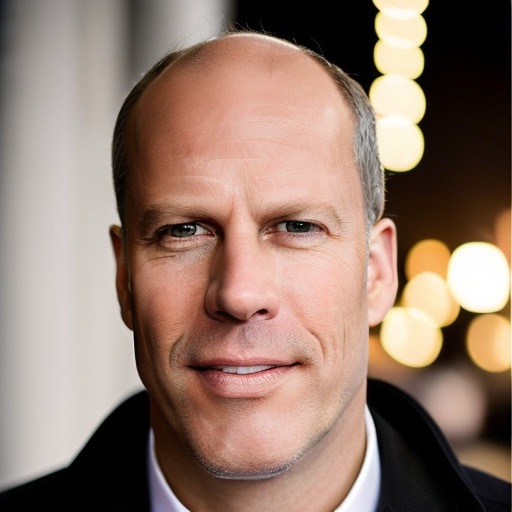

David Kraemer, Founder & Managing Member at 10 || 2 Capital Partners

In this episode, we sit down with David M. Kraemer, Founder of a boutique investment bank and former Vice President at Merrill Lynch and Wilshire Consulting. With deep experience across public and private markets, David shares insights on capital formation, innovation, and navigating complex investment landscapes.

From biotech and MedTech to AI, robotics, and venture capital, his perspective bridges finance and technology in today’s fast-changing world. Tune in to hear how he’s built global partnerships and what drives his success in the ever-evolving world of investment and entrepreneurship.

Julio Martinez-Clark (00:02.241)

Today on the Global Trials Accelerators Podcast, we're joined by David Kramer, founder and managing member of 10Tube Capital Partners. Am I only pronouncing the name of the company correctly?

David Kraemer (00:15.714)

That's correct, that's correct.

Julio Martinez-Clark (00:17.633)

Okay, David helps high growth biotech, medtech and digital health teams secure a smart capital from family offices, VCs, endowments and corporates across North America, Europe and Asia Pacific. With deep experience in capital formation and diligence, he's here to unpack what it takes to fund first human studies in 2025. So David, welcome to the show.

David Kraemer (00:44.002)

Yeah, great. Thanks for having me. It's a pleasure to be here. Absolutely.

Julio Martinez-Clark (00:48.267)

Fantastic, David. So let's get started with your personal professional journey. Tell us about you. Tell us about how you got to where you are today, David.

David Kraemer (00:59.288)

Sure, yeah. Well, as I mentioned in my email, I'm a little bit unorthodox, right, on some of this. But I started on the investment side years ago with Merrill Lynch in New York City. It was more private wealth, also business financing. Then I also worked with the placement agent group that dealt a lot with raising capital for venture capital and private equity funds. So that kind of squared my interest to get more kind of in that private market space earlier stage.

Um, from there, I went to Wilshire consulting, which was only institutional. Um, I was vice president of business development. I worked a lot with, you know, other teams throughout the country in different parts of the world. But there we were a true fiduciary working with like a multi-billion dollar plan. state pension plans, endowments, corporations, and also Wilshire is one of the top, it still is one of the top, um, institutional investment firms, but they got acquired a couple of years ago. Um, and then from there.

I don't know. just had this idea that, you know, I know a lot of these, what I call smart capital sources. And I'd like to always be kind of a student, right? Keep learning. Um, at first I used to be more of a generalist, but I said, why don't I start a company where I can marry what I call like smart capital, which are some of the parts that you mentioned in the intro. Um, and then find really compelling deals or funds for companies, um, due diligence on them.

and then try to help them get from point A to point B. So it's a very long and arduous process, but if you can help those entities get across, and then also, it's a group effort. think people can have a bigger impact. I think my affinity too for kind of the life sciences was around earlier. I just wasn't so much aware of it. I think at this point in my career, I want to have...

Julio Martinez-Clark (02:40.778)

Mm-hmm.

David Kraemer (02:55.254)

Again, something that I could have a bigger impact versus just having a transaction. So even though I have 10 capital partners, I'm still possibly pivoting on a couple of interesting areas, which may be forthcoming, but we'll see.

Julio Martinez-Clark (03:01.951)

Sure. Yeah.

Julio Martinez-Clark (03:11.775)

And what do you read David?

David Kraemer (03:16.346)

I was in New York City for 12 years, but I circle back. I'm in Pittsburgh, Pennsylvania. so I born and raised here. I have, yeah, correct. So I have two children, 10th and 11th grade. My son, is an athlete as well. He's going to be going to Villanova next year, for football. Yeah. It's a nice school. And then my daughter.

Julio Martinez-Clark (03:22.334)

Okay.

Okay, let's do hometown.

Julio Martinez-Clark (03:39.785)

Nice.

David Kraemer (03:44.332)

She's also athletic, but I think she'll be going division one somewhere. We're not sure yet. Most likely track and field. So.

Julio Martinez-Clark (03:48.767)

Okay, good, good, good. All right. So David, let's talk about trends. What do you see happening in the industry, the life science industry, and what political, economic, or industry trends you see that are affecting what we do in the industry?

David Kraemer (04:09.858)

Why I think one of the biggest things that's changed, especially since I've started to focus on this has been China. Right. I mean, the, used to be, yeah, it used to just be an area for manufacturing. Right. But now, I mean, so many entities are now trying to out license, right. Some of their, their new indications and so forth. Also at the speed and brevity, I think that things can get through IND and so forth. Their equivalent is a lot faster than what we have here.

Julio Martinez-Clark (04:17.022)

China.

David Kraemer (04:39.95)

Um, and that's kind of, that's kind of part of a bigger global trend where, know, 50 % of things that get approved or clear to come out of FDA, um, or within here, like within the United States, but I mean, it's a global market now, right? As you know already. So even, even look at like countries like Australia, right? Where now they have that, that new tax rebate. Um, you know, you can go to the ethics committee and get a

Julio Martinez-Clark (04:40.633)

Julio Martinez-Clark (04:56.04)

Yeah.

Julio Martinez-Clark (05:01.214)

Mm-hmm.

David Kraemer (05:09.1)

An update, whether you can proceed or not, four to six weeks versus six to nine. So I think that, and that ties back in with the investors and the capital, which is really the lifeblood of all these industries. How can you optimize that? Not, not run a foul of any regulatory issues and still get the requisite information and, and, you know, the clinical endpoints, in a good, in a good way.

Julio Martinez-Clark (05:10.589)

Yeah.

Julio Martinez-Clark (05:14.555)

Yeah.

David Kraemer (05:38.008)

but do that the most efficiently. think what happened too is pre-pandemic and of course, during the pandemic, right, we had kind of a huge upsurge again, especially with mRNA. But I think, you know, too many entities came out, right? How many oncology indication companies can you have, right? I mean, it's kind of a little frothy. So I think that's one trend is definitely China. I think more globalization, even Latin America, of course.

Julio Martinez-Clark (05:57.221)

Yeah. Yeah. Yeah.

David Kraemer (06:07.874)

as you know, being able to draw upon those other regulatory agencies. And it's easier to get trials too, right? Like even like in Brazil.

Julio Martinez-Clark (06:18.664)

Yeah, absolutely. Yes.

David Kraemer (06:21.57)

I think like there's patient naive treatments where, right, where you can actually get, it's so hard to get people in the trial sometimes, especially in the United States. Correct. Right. If all we're talking about is, you know, a European contingent or U S that really doesn't help the rest of the world, right. It's nice to have that. Yeah.

Julio Martinez-Clark (06:29.754)

Exactly. And diversity too.

Julio Martinez-Clark (06:47.398)

Yeah, yeah.

David Kraemer (06:49.624)

So that's absolutely, I think one big trend. The other one, obviously I'm sure other people will mention it, but it's AI. And I look at it, I look at that, I think also like drug repurposing, right? I mean, instead of, again, this kind of truncates the timeline, which is what we were kind of talking about, being able to use AI machine learning to find the requisite target compound or combination thereof versus having that other part that

Julio Martinez-Clark (06:57.435)

Of course. Yeah.

Julio Martinez-Clark (07:08.038)

Mm-hmm.

David Kraemer (07:18.636)

may take one to three years, I think can actually expedite things as well. Now, is it going to be better than a dedicated group of scientists and so forth? I don't know. think eventually. I think marrying those two together is another way to really expedite things. has to be. mean, AI has been around for years, right? It's gotten a lot more prevalent. Yeah, exactly.

Julio Martinez-Clark (07:29.789)

Excuse me.

Julio Martinez-Clark (07:42.62)

Since the 60s or something.

David Kraemer (07:48.014)

So I think that's another huge trend and it's gonna be exciting to see where it goes because the cool aspect of it is, you know, with the computing power and the way the technology and the self-learning, eventually we're gonna have that crossover point, right? I forget what it's called, but where, you know, it may be completely independent. So you wanna have some ethical guidelines around that, of course, right? And I think...

I think as an enterprise, think the United States has been a little more open to taking those risks, whereas say Europe has been a little bit more, a little more closer to the vest. Let's look and see. But I think they're realizing as a competitive advantage, you need to also open the kimono a little bit, right? And take some chances, but do it properly. Then of course, China, I mean,

Julio Martinez-Clark (08:29.244)

Yeah.

Julio Martinez-Clark (08:37.284)

Yeah.

David Kraemer (08:44.622)

They've kind of swung the pendulum a little bit differently, right? Back when we had the CRISPR babies, right? In 2018, which was very, very interesting. But again, I think that shot sent shockwaves throughout the world. Like, you know, we're kind of playing God here a little bit. Right? So how do we use that? How do we use that to our, to our benefit, but do it again, ethically. And that's, that's a slippery slope too, because if you're creating

Julio Martinez-Clark (08:51.431)

Mm-hmm.

Julio Martinez-Clark (09:02.588)

Yeah.

David Kraemer (09:15.16)

you know, designer babies, so to speak, you're going to have people that can afford it and you'll have the haves and have nots. So I think, I don't know, it's all still playing out, but I think it's a wonderful thing to have all these, these exciting times and, and, and technologies at our disposal, just how do we do it the most efficiently, properly. And then of course, you know, investors want to see, can we get a commensurate return, but also still have an impact.

Julio Martinez-Clark (09:45.22)

Absolutely, agree, 100%. All right, David, so let's talk about any exciting projects you're working on right now. Are you sure something in that regard?

David Kraemer (09:55.566)

Yeah, have one. I have one I'm under NDA, it's, I mean, this kind of goes to an area I keep learning a lot more about, is the cardio metabolic and cardiology just in general, right? If you look at the code morbidity, look at code morbidities across the world. I mean, obviously cancer is huge, but I mean, cardiovascular disease is still, we're still kind of like in the 1980s with that, I think to a certain degree.

Julio Martinez-Clark (10:22.428)

Yeah, yeah.

David Kraemer (10:25.222)

so there's a company over in Europe that I've been working with a little bit, where they take CD 34 stem cells after somebody's had an acute myocardial infarction. like a severe head, heart attack, how do you take the, it's a cell therapy. So it'd be a one-time dose. but there are, think they're between phase one and two B right now. but people that have gotten their.

Julio Martinez-Clark (10:40.261)

Mm

David Kraemer (10:54.81)

their, their therapeutic benefit. what they basically do is they take those cells out, they reprogram it the way they're doing it. And then they put it back into the fibroidic area. And if you have, yeah, if you have a severe heart attack, that's never going to, the area usually does not grow back, right? The blood flow doesn't come there. but the caveat is there's, there's a short window. I think it's between three to four weeks after the actual event.

Julio Martinez-Clark (11:07.93)

Wow.

Julio Martinez-Clark (11:15.643)

Sure.

David Kraemer (11:24.974)

until like four to six thereafter. So for people that have had that and still want to have a good quality of life, hopefully what the studies have showed so far is that they they inject that back in there. It's minimally invasive, believe it or not. And then they can kind of go about their life. So again, it's not approved yet, but it's, yeah. So another area too, I think is,

Julio Martinez-Clark (11:44.984)

Wow, amazing. Yeah, yeah, yeah.

David Kraemer (11:54.85)

I may be working with a company is the circular mRNA, right? Because as you know, with mRNA, you have those two strands and a lot of times those things can get broken and not be as effective. think with circular mRNA, there's a company called Ornitherapeutics. I'm not working with them, but it's a great way to get through the liver and get to the other parts of the body and deliver a payload, but do it effectively.

Julio Martinez-Clark (12:06.244)

Mm-hmm.

David Kraemer (12:24.108)

and not have off target effects. And I think that's going to be just like mRNA was in 2020. think the CERC or circular mRNA will be something that's, you know, one of the big, achievements of this decade, I think. So, So I think that, in other areas, you know, that may be a combination product.

Julio Martinez-Clark (12:40.571)

Interesting.

David Kraemer (12:52.814)

Right? Maybe you have a device that can also deliver a therapeutic benefit. Those are in areas that I may be working on something too. But, you know, as a small entity, you can only work on so much. Oh, good. So.

Julio Martinez-Clark (13:07.834)

Of course. Yeah. Yeah. Yeah. Yeah, but it's amazing. I kind of identify with what you're saying because I am the CEO of CRO that specializes in first in human clinical trials. So I am always at the forefront of what's going on. Every day I get an email with some new technology. Many of them sound like science fiction. So.

David Kraemer (13:19.786)

I am the CRO that specializes in personal images for trials. So I am always at the forefront of what I am. Every day I get a email with some new technology.

Julio Martinez-Clark (13:36.986)

So yeah, I love seeing how fast things are moving and learning about how life science progresses so much and science in general progresses so much that we're gonna be living until, I don't know, 120 years old or something like that because there's always something to treat all these diseases of aging that we have.

David Kraemer (14:02.862)

Right. Yeah. Yeah, it's amazing. Well, that that kind of speaks to the one of those other sectors, too. That's adjacent is the longevity. Right. Trying people. I don't know so much about it, but I think I think that I think psychedelics, too, are kind of coming up. Yeah. Again, not not not kind kind of an abusive way, but I mean, something that there's a lot of evidence.

Julio Martinez-Clark (14:20.194)

yes, big area of development.

David Kraemer (14:32.504)

Plus the cost of doing it isn't that expensive, right? I mean, it's kind of like mother nature. A lot of, right. So I think those are very interesting. Yeah.

Julio Martinez-Clark (14:37.1)

Exactly.

Yeah, Yeah, yeah. I was going to say that I think Johns Hopkins and some top universities in the US and hospitals are involved in psychedelic research because it's a hard area of research to treat anxiety, depression and all that.

David Kraemer (14:57.42)

yeah. Yeah. Well, especially too, when we had the pandemic, mean, so many people are isolated. think it just exasperated what people had on for the speaking of Hopkins too, I think it was in my profile. I actually went back near. Yeah. So I I've done a real pivot, but I'm nearing completion of a master's in biotechnology enterprise and entrepreneurship. Yeah. So I'm probably the oldest person in the cohort, but

Julio Martinez-Clark (15:03.191)

Yes. Yeah. Yeah. Yeah.

Julio Martinez-Clark (15:11.981)

Yes, I saw that. Yeah.

Julio Martinez-Clark (15:21.347)

Fantastic.

David Kraemer (15:26.382)

It's okay. So, but I have a lot, you know, I the business experience and so forth, but it's, it's very interesting. Yeah. I I love it. think it's the professors are, you know, it's a wonderful organization, institution, hopefully I should have that done by the end of this year. So.

Julio Martinez-Clark (15:26.462)

Hahahaha!

Julio Martinez-Clark (15:47.274)

Excellent. Congratulations. I was fortunate enough, David, to work for John Hopkins for a year and a half. And yeah, it was quite an experience in Baltimore, actually. So I loved it.

David Kraemer (15:59.342)

Yeah, for me it's all online and remote so I don't have to take it like two classes per term so it's more doable. But yeah. So, thank you for listening. I'm going to be the only one talking here. So, I'm going go to soon. There's something I want to say about the significance of the data.

Julio Martinez-Clark (16:03.478)

Online, that's what I imagine, yeah.

Julio Martinez-Clark (16:11.961)

Okay. All right. So David, let's talk about the heart of the matter here. So let's talk about the state of the market. Let's, oh please, paint the 2025 landscape. Who is still writing checks for first in human trials, family offices, the specialists, disease strategies, I'm sorry. And what's changed since?

David Kraemer (16:33.774)

with the CIS funding.

two, three.

Julio Martinez-Clark (16:40.952)

the risk tolerance of 2022, 2023. Why do we have these massive 180 degree shift in the investment sentiment of these investors? So what can you tell us about it?

David Kraemer (16:43.022)

from 2022 to 2023. Why do we have to see how the state of the is being served in medicine and science?

What can you tell us about Yeah, well again with the pandemic, mean that spurred a lot more focus in life sciences in general. And again, I think it got kind of frothy and I think a lot of people were quote writing checks that really didn't have the knowledge, right? It was more like, this is a very, this is a nice shiny object, right? I think I don't want to have fear. Right. Right. I don't want to have fear or FOMO fear of missing out.

Julio Martinez-Clark (17:10.454)

Hmm.

Julio Martinez-Clark (17:14.903)

It's like AI now.

Julio Martinez-Clark (17:23.499)

Yeah, exactly.

David Kraemer (17:23.594)

So I think a lot of people got burned, but I think the ones that are astute that are not just journalists, you know, have been there. Cause I think whenever you have, you know, good science, good technology, good management, and a clear pathway on how to get to somewhere, whether it's and a and IPO, et cetera. people will be forthcoming. yeah, I think the check sizes this year have been smaller, but I've looked at some of the and a data as well. And it's.

And the aggregate, we're actually doing pretty well, right? Because we've been in, yeah, I mean, biotech in general has been kind of in a winter, right, for the last couple of years. And valuations have come back down to market or to earth, so to speak, right? So I think that's a case. Definitely corporates. And then on top of that, as you know, we have a huge patent cliff coming, right? So.

Julio Martinez-Clark (17:57.121)

Mmm.

Julio Martinez-Clark (18:03.819)

Yeah.

Julio Martinez-Clark (18:11.521)

Okay.

David Kraemer (18:23.682)

by 2030. So a lot of big farmers out there, again, trying to acquire things or license things. So I think that's going to be a good catalyst, especially for, you know, not shiny objects, but things that actually have tangible real benefit that have a large tangible market for the people can capitalize on. So, yeah, so family offices are always going to be there. I think they still are. I think the ones that are more specialized.

can weather the downsides because they're really more permanent patient capital, right? Whereas a VC fund in general, right? They have a certain timeline typically, right? They want to get a commensurate return, get it back to the limit partners and then redeploy. So I think that's, I think high net worth investors that are astute, you know, for the very early part, you know, the pre-C type money I think is still there.

Julio Martinez-Clark (19:06.774)

Sure. Yeah.

Yeah.

Julio Martinez-Clark (19:20.085)

Mm-hmm.

David Kraemer (19:22.392)

corporate venture capital as well, as I mentioned, even some large, you know, sovereign type entities. But I mean, those, check sizes they have to write are enormous, right? So that they would, they would be falling on like, you know, series C and so forth. But no, I think the pendulum has swung fingers crossed. And the interesting thing, like I mentioned too, is I think we just having this convergence.

Julio Martinez-Clark (19:33.224)

Exactly. Yeah.

Julio Martinez-Clark (19:39.414)

Mm-hmm.

David Kraemer (19:51.574)

of all these other areas, right? Life sciences, med tech, AI, robotics. I mean, I know it's kind of frothy and cool to talk about, but I really think it's going to be a game changer over the next five to 10 years. And people don't, you know, they don't want to miss out on that, but you don't want to bet the farm either, right? You want to kind of do it, do it judiciously. And that comes back to, think, you know,

Julio Martinez-Clark (19:55.594)

Mm-hmm.

David Kraemer (20:22.69)

Let's look at your typical family office. I mean, when I say family office, I'm thinking like 500 million and up in net worth. A lot of them usually have their entrepreneurs, you know, they had a large wealth creation, worked very, very hard. But, you know, they might have a subject matter area that's obviously not in this space. So they're looking to diversify. So taking a more, taking a more calculated approach, right.

Julio Martinez-Clark (20:46.102)

Mm-hmm.

David Kraemer (20:51.0)

building that out, hiring the right people or getting the right advisors, I think is always a way to do it, right? You don't have to try to win a home run on day one, right? So I think that's definitely gonna be there. And we have a different administration now too that seems to be more pro-business, but again, who knows it's gonna happen, but. Right.

Julio Martinez-Clark (21:02.156)

Absolutely, yeah.

Julio Martinez-Clark (21:14.515)

Yes, exactly. It's very unpredictable.

David Kraemer (21:20.216)

I mean, it's the only part of the year, right? NIH was getting guillotined everywhere. Now it seems to be coming back a little. So it's very interesting times. But yeah, no, I think the pendulum is swung. I think there's good opportunities for the right people, the right leadership and the right benefits, whether it's a device or a therapeutic.

Julio Martinez-Clark (21:23.647)

Yeah, the FDA.

Julio Martinez-Clark (21:38.889)

Okay.

Julio Martinez-Clark (21:46.294)

I was going to ask you that. It was going to be my next question about the invisible, the ideal invisible FIH first in human package. So when you evaluate and first in human ready company, what must be true? Regulatory clarity, preclinical robustness, KOL backing, payer relevant endpoints or early strategic, strategic interests, you know, from larger companies, potential acquirers.

David Kraemer (22:07.96)

Julio Martinez-Clark (22:15.401)

So what do you think is the ideal mix so that the company gets really, really sexy in front of investors?

David Kraemer (22:24.386)

Yeah, well, I think, again, I think if you have the science, have the right people, particularly if you have a founder that has been there, done that before, right? Do they have a better, I think that that provides more credibility, right? Now the other side that is what if you have somebody that is a first time founder, but they have something that's really novel and really impactful? You know, I think what happens if you have somebody that has more of an affinity for that area.

Julio Martinez-Clark (22:31.529)

Mmm. Yeah.

Julio Martinez-Clark (22:39.54)

Yeah.

Julio Martinez-Clark (22:46.249)

Mm-hmm. Mm-hmm.

David Kraemer (22:53.838)

They may be more lenient on that. think initially. Um, but yeah, you said it. mean, you want, you want to have everything mapped out, like you're going to take it to market from the get-go, right? And most of these entities, most of these entities, as you know, don't do that. They get acquired because how are you going to build out a sales force? You know, when you're just starting from ground zero, you're not, um,

Julio Martinez-Clark (23:06.645)

Yeah. Okay.

Julio Martinez-Clark (23:18.067)

Yeah. Yeah.

David Kraemer (23:20.3)

And you mentioned earlier in our discussion, CRO, right? So do you have somebody that understands your space that you can rely upon, leverage yourself and branch out that way? Very, very few entities have access to all that from day one, right? So, yeah. So I think having things again, more calculated, thoughtful approach, I think wins.

Julio Martinez-Clark (23:26.729)

Mm-hmm.

Julio Martinez-Clark (23:39.08)

Yes, sure. That's a good point.

David Kraemer (23:50.198)

or it gives you a better chance of versus, you know, I have this awesome indication I'm trying to focus on and, you know, try to hit everything in one day. It just doesn't work. So I think that's, you know, I think again, I think you will be found if you have great technology, great management team, a good indication in a large market to address.

Julio Martinez-Clark (23:53.044)

Mmm.

Julio Martinez-Clark (24:01.992)

Hehehehehe

David Kraemer (24:19.212)

And if again, if we go back to what we said earlier, you know, kind of utilizing the global approach to expedite and be more cost effective. And there's a, there's visual stage really help. so, but again, you know, every family office too, again, I'm not harping on them total, but they're all different, right? Just like every, every person you meet is different, right? They don't have any, any. So,

Julio Martinez-Clark (24:27.517)

Absolutely. Yeah.

Mm.

Julio Martinez-Clark (24:43.717)

Exactly. Yeah, absolutely.

David Kraemer (24:49.08)

But yeah, it's definitely exciting times and it's going to be interesting to see what happens. Things just keep getting more more available, more transparent. you know, but I also say that with an asterisk too, because it still is kind of frothy in certain ways, right? It's kind of swung back, but it's getting better.

Julio Martinez-Clark (25:08.935)

Mm-hmm.

Julio Martinez-Clark (25:13.62)

Okay, I usually hear that interest rates affect the investment dynamics. So what do you think is gonna happen? What's happening there? Is this true or not? Are we gonna see lower interest rates coming up? What's your take on this?

David Kraemer (25:31.052)

Yeah, well, I mean, as you know, they raised rates substantially some years back, but they've been cutting. I still think we have. think it, don't want to be a pontificator, but I think there's still another 25 or so basis points that will be cut here in the U.S. And that that increases the cost, lowers the cost of capital, which is great. Right. So.

Julio Martinez-Clark (25:47.656)

Okay.

Julio Martinez-Clark (25:52.049)

Yeah, exactly. That's my point.

David Kraemer (25:55.17)

Right. So yeah, no, that's definitely a tailwind for this industry and just innovation in general. Right. I know at the beginning of this year, people were claiming that, you know, the apply won't be any cuts. We've already had some. So, you know, I don't know what goes on exactly at the Fed behind the scenes, but I do think that it definitely is going to happen. It's going to be a nice tailwind. And then also if you look across the pond right in Europe,

Julio Martinez-Clark (26:03.187)

Mm.

David Kraemer (26:25.666)

I mean, they need, they need some type of catalyst as well. I they're not, their economy is not doing that that well, generally speaking. So I think they'll be cutting potentially some more as well. but yeah, you can get a lower cost of capital. People want to take that and try to innovate with it. so hopefully, yeah, hopefully that adds a nice, a nice little boon for us for this year and part of next year.

Julio Martinez-Clark (26:44.562)

Sure. Yeah.

Julio Martinez-Clark (26:54.291)

Good. So David, before we wrap up the conversation, one last question that I have is about another trend that I see happening, which is precision medicine. I think I saw that in your profile. I think it's related to the master's degree that you are doing now. Radio-pharmaceuticals and theranostics. That's a very hot area right now, I read, and I'm actually involved in that space as we speak.

David Kraemer (27:05.686)

section.

I think it's

David Kraemer (27:19.63)

I could only contain that space as you see. And you can't expect for me, after my company, that we have to say everything. And I can't imagine, before you actually have to it, that you have have some sort of experience of this. I'm very going to say it.

Julio Martinez-Clark (27:22.427)

And it's a new space for me, for my company. And what do you have to say about that? I mean, I'm sorry, before you answer, I just came back from the Astro conference in San Francisco, the American Society of Radiation Oncology. And I will say that 70 % of the conversation was about radiopharmaceuticals and theranostics. So what's your take on that space?

David Kraemer (27:38.23)

And I was like, seven.

David Kraemer (27:43.054)

and build a practice of recluse and framework.

Yeah, no, it's definitely, it's definitely an interesting area. I think it's got a lot of great benefit. It's just a matter of having the right setup, right? Is is it available to everybody because of what you need to have behind that type of therapeutic benefit, right? it's not like you're just mastering something. but precision medicine, that that's definitely a huge, theme that I think is not going to go away. think, I think initially people try to force it.

Julio Martinez-Clark (28:12.327)

Mm.

David Kraemer (28:17.912)

But now again, going back to this confluence of all this technology and the global, I guess, intellectual capital we can draw upon. I think that is the future or part of the future of healthcare, right? Being able to assess somebody on an initial visit and see what is wrong or even flipping the channel. It could be the other way trying to optimize, right? Not just, not just reactionary, but also can you optimize?

Julio Martinez-Clark (28:32.753)

Hmm.

David Kraemer (28:47.918)

you know, through precision medicine, somebody's lifestyle, their longevity. I don't know as much about it. I mean, I'm getting more up to speed on it, but I definitely think that is a more boutique and individualistic way to help people. Right. Because I mean, if you look at our health care system in general, it's so reactionary. It's so, you know, especially when you get into

like, you know, a BMI chart, just for an example, right? Like, it's so outdated, like maybe somebody's got some heavy weight, but they're actually much, right? So, would have been great to be at that conference, I'm sure. I'll have to look at some commentary, but no, think precision medicine is huge. And yeah, the more bespoke that you can get for the patient, I think the better.

Julio Martinez-Clark (29:25.339)

Yeah, exactly. Yeah, I agree.

Julio Martinez-Clark (29:37.797)

Yeah.

Julio Martinez-Clark (29:46.211)

Exactly. Yes. All right, David. Yeah. All right. So huge thanks to David Kramer of 10-2 Capital Partners for a masterclass on funding producing humans in today's market. If this episode helped you, share it with your network, with a founder or investors.

David Kraemer (29:47.81)

the better off it'll be.

if that answers your question.

Julio Martinez-Clark (30:13.143)

and subscribe to the Global Trial Accelerators Podcast for more conversations on accelerating early phase trials worldwide. Thank you so much, David, for being in the show.

David Kraemer (30:23.758)

Great, thank you.

Founder and Team Player

David Kraemer is a capital formation, business development, and investment executive with more years of experience across institutional consulting, private wealth, private markets, and life sciences and MedTech innovation. He has held roles at Merrill Lynch in New York and Wilshire Associates in Pittsburgh and Santa Monica, before eventually founding 10‖2 Capital Partners, a boutique advisory firm supporting biotech, MedTech, DeepTech, and healthcare ventures. His representative mandates include advisory work for a $100M first-time global VC fund led by executives from Venrock, McKesson, and Gilead; a HealthTech/AI-focused Fund III with portfolio companies such as VIOME and Deep Instinct; and private companies advancing FDA-cleared and AI-driven medical technologies later acquired by strategics. Currently completing his Master of Biotechnology Enterprise & Entrepreneurship (MBEE) at The Johns Hopkins University, David is focused on bringing this combined expertise into a full-time leadership role within a growing biotech, MedTech, investment fund, or the innovation arm of an integrated healthcare organization.